Funds transfer below the threshold of

R10 million rand per year

- For the movement of funds offshore, SARS has, as of April 2023, implemented the Approval of International Transfer (“AIT”) process. What this means, is where South African tax residents who need to move amounts exceeding R1 million per year or ceased tax-residents who need to move any amount, out of South Africa, formal approval is needed from SARS.

- South African citizens who have financially emigrated and wish to transfer funds out of South Africa must apply for an Approval for International Transfer (AIT) from the South African Revenue Service (SARS), regardless of the amount.

Navigating

Compliance

- Comply with SARS requirements through the meticulous compilation and aligned submission of necessary documents.

Our Commitment

to Service

- We assume responsibility for all necessary paperwork and communication with SARS.

- You will receive regular updates throughout the entire process.

- Actively pursue a resolution after the 21-day SARS response window.

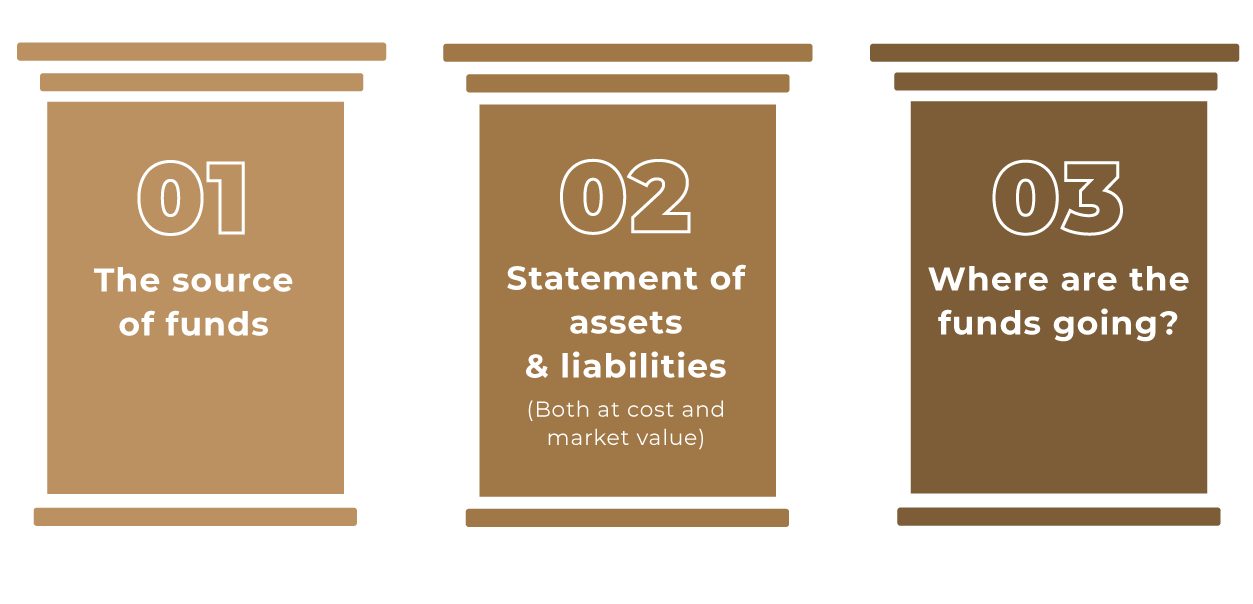

3 PILLARS OF SARS' STRATEGIC INTENT

The new AIT process and the changes SARS has implemented all follow SARS’ strategic intent:

AIT PROCESS FLOW

STEP 01

Tax Diagnostic

STEP 02

The Risk and Reconciliation Report

STEP 03

The AIT Process

This best practice process flow does mean that you may be in contact with various financial professionals, including tax returns specialists, financial emigration experts, and tax attorneys. Tax Consulting South Africa has a multidisciplinary team of more than 150 professionals across all aspects of the tax industry.

FAQs

Previously, when one sought to either financially emigrate or transfer large sums out of the country, they would either have to complete the “Emigration” TCS Pin or “Foreign Investment Allowance” (“FIA”) TCS Pin, respectively. The new AIT Process consolidates these two and is now the go-to requirement when it comes to the approval of moving funds out of South Africa.

The AIT process applies to both South African tax residents who transfer more than R1 million out of South Africa in a calendar year, as well as for taxpayers who have ceased their tax residency in South Africa but need to move funds abroad, from a South African source, for whom this applies for any amount being remitted.

SARS permits South African tax residents to transfer up to R1 million offshore annually under the Single Discretionary Allowance (SDA). This allowance is exclusive to individuals who maintain their South African tax residency.

For tax residents, an AIT Pin is required when transferring more than R1 million out of South Africa in a calendar year. If you have ceased being a tax resident, an AIT Pin is necessary for any amount you wish to transfer out of the country in the same period.

There is a usual turnaround time for SARS approval on an AIT application is 21 business days, where no additional information or verification required.